Fondsen Focus

![[Main Media] [Flash Note] [CP] Coloured buildings Carmignac Patrimoine](https://carmignac.imgix.net/uploads/article/0001/05/7dbc9184f5a55630cf58e292377f78eb1c2de428.jpeg?auto=format%2Ccompress)

Carmignac Patrimoine: the Fund Manager’s thought

Carmignac Patrimoine A EUR share class posted +4.8% vs +0.9% for the reference indicator 1 and -2.9% for its Morningstar category 2.

The handling of the Covid-19 pandemic triggered a substantial shock to growth. After contracting in the second quarter, the global economy recovered in the third – thanks to life support for consumer spending.

Indeed, the speed, scope and form of the authorities’ response to the emergency were truly unprecedented. Central banks and governments took concerted action to ensure that enough money would continue to flow to economic agents – businesses and households – to keep them going and to regulate the debt financing of economic activity via the financial markets and banking system. However, the rally in financial assets currently under way is highly dependent on monetary and fiscal support flies in the face of what are still patchy economic fundamentals and a most uncertain outlook.

Our experience in managing previous market crises was useful. This time again, like in 2000, in 2008 and 2011, the first imperative was to rapidly take the full measure of the risk, and act on it. The globalization of the epidemic was a clear possibility in our mind. However, our judgement was that, whereas healthcare systems in Europe and the US were certainly not prepared for the pandemic, policy makers were prepared to deal with a market crisis.

-

Our highly flexible asset allocation gave us the agility we needed to get through the period.

-

Indeed, a solid portfolio construction and good risk management during the crisis allowed us to re-expose the Fund to take advantage of market dislocation and profit from the rebound that followed.

- On the equity front, our allocation bias for secular growth stocks were the largest contributors to performance, thanks to both their resilience in down markets and sharp rebound in the aftermath. The former can be attributed to their low correlation to economic activity while the latter notably stems for the flight to growth that took place. Indeed, the crisis we are experiencing has accelerated several major underlying trends including digitization and ecommerce. Finally, the combination of loose monetary and fiscal policies led us to build up a position in goldmines to hedge against a risk of higher inflation expectations, that turned out to be very profitable.

- On the fixed income front, we limited losses in the drawdown by quickly cutting our exposure to peripheral bonds and Emerging market debt while increasing our cash holdings. Furthermore, the third quarter brought back happy days to corporate credit in the form of rising yields and capital gains made possible by narrowing interest-rate differentials. We believe this segment still offers a great deal of value.

Carmignac Patrimoine - A Balanced Portfolio

The portfolio composition may change anytime

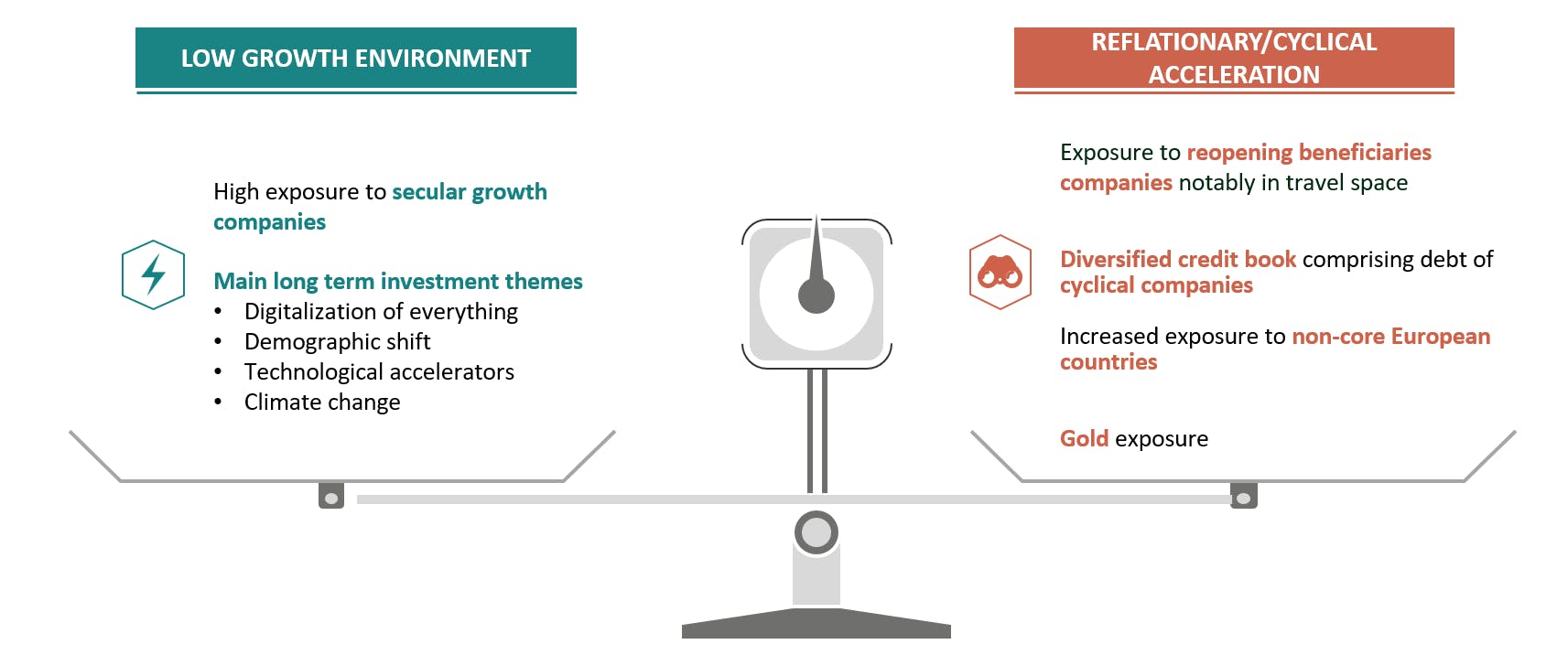

Two scenarios are basically shaping up. On one hand, the shutdown of activities and slow reopening has made the economy more sluggish than ever; on the other, both Central banks and governments are providing an unprecedented support, while a vaccine could be found in the coming months, opening the door for higher inflation expectations and positive economic surprises.

We are therefore keeping on one side our focus on secular growth companies, albeit we’ve taken profit on some of our biggest contributors. Slow growth means it is becoming increasingly hard for companies to become or stay profitable, not to mention the shock many of them have suffered from with the economic pause. Conversely, secular growers -companies that perform regardless of the overall health of the economy- are seeing increased interest from investors. Also, Central banks’ loose policies are intended to keep rates low for longer, which could sustain current valuation. A lot of them can be found in the technology sector or in healthcare, an ever-evolving industry. Finally, we have selectively signed up to some IPOs, which had the busiest quarter since 2000 in volume terms.

On the other side, we have adjusted the portfolio to take into account this liquidity-driven environment and positive news flow that could benefit cyclical assets. We are notably playing this thematic via the travel industry, that has suffered a lot from the crisis but benefit from reopening economies. We nevertheless optimize such exposure across the capital structure as such companies are not necessarily attractive in terms of both equity and debt. For example, Airline companies are asset heavy and leveraged, denting on their current and future profitability, and making them unattractive for equity investors. However, their high tangible assets (namely planes) act as collaterals for the cash they are raising, making them attractive for creditors.

As a hedge against a rise in inflation expectations, we hold exposure to goldmines. We are also maintaining our exposure to non-core sovereign debt, supported by coordinated action of governments in the region. We have nevertheless taken profit on our Italian debt as regional elections are coming up.

Carmignac Patrimoine A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Patrimoine A EUR Acc | +8.81 % | +0.72 % | +3.88 % | +0.09 % | -11.29 % | +10.55 % | +12.40 % | -0.88 % | -9.38 % | +2.20 % | +5.51 % |

| Referentie-indicator | +15.97 % | +8.35 % | +8.05 % | +1.47 % | -0.07 % | +18.18 % | +5.18 % | +13.34 % | -10.26 % | +7.73 % | +4.13 % |

Scroll rechts om de volledige tabel te zien

| 3 jaar | 5 jaar | 10 jaar | |

|---|---|---|---|

| Carmignac Patrimoine A EUR Acc | -1.44 % | +2.92 % | +2.06 % |

| Referentie-indicator | +3.32 % | +5.42 % | +6.72 % |

Scroll rechts om de volledige tabel te zien

Bron: Carmignac op 28/03/2024

| Instapkosten : | 4,00% van het bedrag dat u betaalt wanneer u in deze belegging instapt. Dit is het hoogste bedrag dat u in rekening zal worden gebracht. Carmignac Gestion rekent geen instapkosten. De persoon die u het product verkoopt, informeert u over de daadwerkelijke kosten. |

| Uitstapkosten : | Wij brengen voor dit product geen uitstapkosten in rekening. |

| Beheerskosten en andere administratie - of exploitatiekos ten : | 1,51% van de waarde van uw belegging per jaar. Dit is een schatting op basis van de feitelijke kosten over het afgelopen jaar. |

| Prestatievergoedingen : | 20,00% max. van de meerprestatie als het rendement sinds het begin van het boekjaar hoger is dan dat van de referentie-indicator en er geen minderprestatie uit het verleden meer moet worden goedgemaakt. Het feitelijke bedrag zal variëren naargelang van de prestaties van uw belegging. De schatting van de totale kosten hierboven omvat het gemiddelde over de afgelopen vijf jaar, of sinds de introductie van het product als dat minder dan vijf jaar geleden is. |

| Transactiekosten : | 0,63% van de waarde van uw belegging per jaar. Dit is een schatting van de kosten die ontstaan wanneer we de onderliggende beleggingen voor het product kopen en verkopen. Het feitelijke bedrag zal varieert naargelang hoeveel we kopen en verkopen. |

1 Reference indicator: 50% MSCI AC World NR (USD) (net dividends reinvested), 50% Citigroup WGBI All Maturities (EUR). Quarterly rebalanced.

2 Morningstar Category: EUR Moderate Allocation - Global. Source: Carmignac, 30/09/2020. Annualized performance as of 30/09/2020. Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged. Performances are net of fees (excluding possible entrance fees charged by the distributor). © 2020 Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. From 01/01/2013 the equity index reference indicators are calculated net dividends reinvested.

A EUR Acc share class ISIN code: FR0010135103. Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Carmignac Patrimoine E EUR Acc

Het indicator kan variëren van 1 tot 7, waarbij categorie 1 overeenkomt met een lager risico en een lager potentieel rendement, en categorie 7 met een hoger risico en een hoger potentieel rendement. De categorieën 4, 5, 6 en 7 impliceren een hoge tot zeer hoge volatiliteit, met grote tot zeer grote prijsschommelingen die op korte termijn tot latente verliezen kunnen leiden.

Aanbevolen minimale beleggingstermijn

Laagste risico Hoogste risico

Risico's die in de indicator niet voldoende in aanmerking worden genomen:

KREDIETRISICO: Het kredietrisico stemt overeen met het risico dat de emittent haar verplichtingen niet nakomt.

TEGENPARTIJRISICO: Risico van verlies indien een tegenpartij niet aan haar contractuele verplichtingen kan voldoen.

Inherente risico's:

AANDELENRISICO: Risico dat aandelenkoersschommelingen, waarvan de omvang afhangt van externe economische factoren, het kapitalisatieniveau van de markt en het volume van de verhandelde aandelen, het rendement beïnvloeden.

RENTERISICO: Renterisico houdt in dat door veranderingen in de rentestanden de netto-inventariswaarde verandert.

KREDIETRISICO: Het kredietrisico stemt overeen met het risico dat de emittent haar verplichtingen niet nakomt.

VALUTARISICO: Het wisselkoersrisico hangt samen met de blootstelling, via directe beleggingen of valutatermijncontracten, aan andere valuta’s dan de waarderingsvaluta van de ICBE.

RISICO VAN KAPITAALVERLIES: Dit deelbewijs/deze aandelenklasse biedt geen garantie voor of bescherming van het belegde kapitaal. U ontvangt mogelijk niet het volledige belegde bedrag terug.

Meer informatie over de risico's van het deelbewijs/de aandelenklasse is te vinden in het prospectus, met name in hoofdstuk "Risicoprofiel", en in het document met essentiële beleggersinformatie.