Fondsen Focus

![[Background image] [CI] Blue sky and buildings [Background image] [CI] Blue sky and buildings](https://carmignac.imgix.net/uploads/article/0001/05/CI_WEB.jpg?auto=format%2Ccompress)

Carmignac Investissement: the Fund Manager’s thought

Carmignac Investissement had a strong third quarter, generating 7.2% of performance while the reference indicator gained 3.6%, resulting in relative outperformance of 3.7%. This brings the fund’s 2020 performance through the end of the third quarter to 15.8%, an outperformance of 18.7% versus the reference indicator.

The third quarter marked the ongoing recovery of the global economy from the COVID related low point in March. In the U.S., income levels remained largely consistent with pre-COVID levels due to fiscal stimulus and rebounding employment.

Consumer balance sheets are robust, with personal savings up $1.7 Trillion since February and consumer net worth at an all-time high.

U.S. Covid case counts stabilized in August and have only risen modestly as schools reopened and indoor dining resumed. While European COVID infection trends have been more concerning, it is important to note that the mortality rate in both the US and Europe has fallen as therapeutics have improved, making it unlikely that economies return to the state of lockdown experienced at the end of the first quarter. While we envision a steady improvement in global economic activity as fiscal and monetary policies remain supportive – the “check mark” shaped recovery mentioned in our last letter – it is clear that a widely distributed vaccine is required for activity to recover to pre-COVID levels. Our expectations are for one or more vaccines to be approved for limited use in late Q4 with wide U.S./European distribution in late Q1 or early Q2 of 2021.

In the interim we believe that fiscal support will remain in place to “plug the gap”. While U.S. fiscal policies have become highly political, we see the election as a clearing event that will ensure the fiscal support needed to reach post-vaccine normalization. The election is additionally highly relevant for forward tax rate, fiscal and regulatory policy and we envision many stock selection opportunities to present themselves once we have resolution.

With this backdrop in mind our portfolio construction is balanced between core positioning in secular growth stocks, which are not directly affected by the economic backdrop and benefit from the low interest regime, and some opportunistic exposure to companies levered to a normalization of behaviour post-vaccine, mainly in the travel sector.

-

Our focus within secular growth is mainly in the Technology, Healthcare, Consumer and Fintech sectors.

-

As noted in our last letter, these core positions proved extremely resilient to a global economic stoppage – consumers and enterprises simply did not stop adopting the powerful trends of e-commerce, digital payments, cloud-based software, and streamed entertainment.

Moreover, as the world adjusted to quarantine and “Work from Home/Stay at Home” dynamics, many of these adoption curves were vastly steepened, pulling forward penetration rates and profits into the near term. Our view is that these penetration rates will be largely maintained as global economies re-open and continue to higher levels over time. Of course, we are always sensitive to the risk/reward of our holdings, and we are very willing to take profits when we believe returns be less favourable.

On a sector basis, the Fund’s portfolio saw gains over the third quarter mainly from the Consumer Discretionary, Technology, Communications Services, and Healthcare sectors. Third quarter returns in Consumer Discretionary were again dominated by significant e-commerce positions in Amazon and JD.com, which were notable beneficiaries of the COVID crisis, as well as from a new position in Chinese electric vehicle manufacturer NIO. Technology returns benefited from strong software performance by Salesforce.com and Snowflake, a data analytics company that we had followed for years as a private company, which positioned us well to receive a significant allocation when it went public in September. Our performance in Communications Services was led by positions in Facebook, Nintendo and Twitter, and our Healthcare performance was once again led by Chinese positions: Zhifei Biologic and Wuxi Biologics. Sector losses were led by relative weakness in U.S. healthcare positions which underperformed due to election uncertainty.

As we finish 2020 and look towards 2021, we believe that we are likely to remain in a low growth environment as we recover from COVID headwinds, and thus that secular growth is preferable. We continue to search for investment ideas where we feel we can formulate a differentiated view from the consensus.

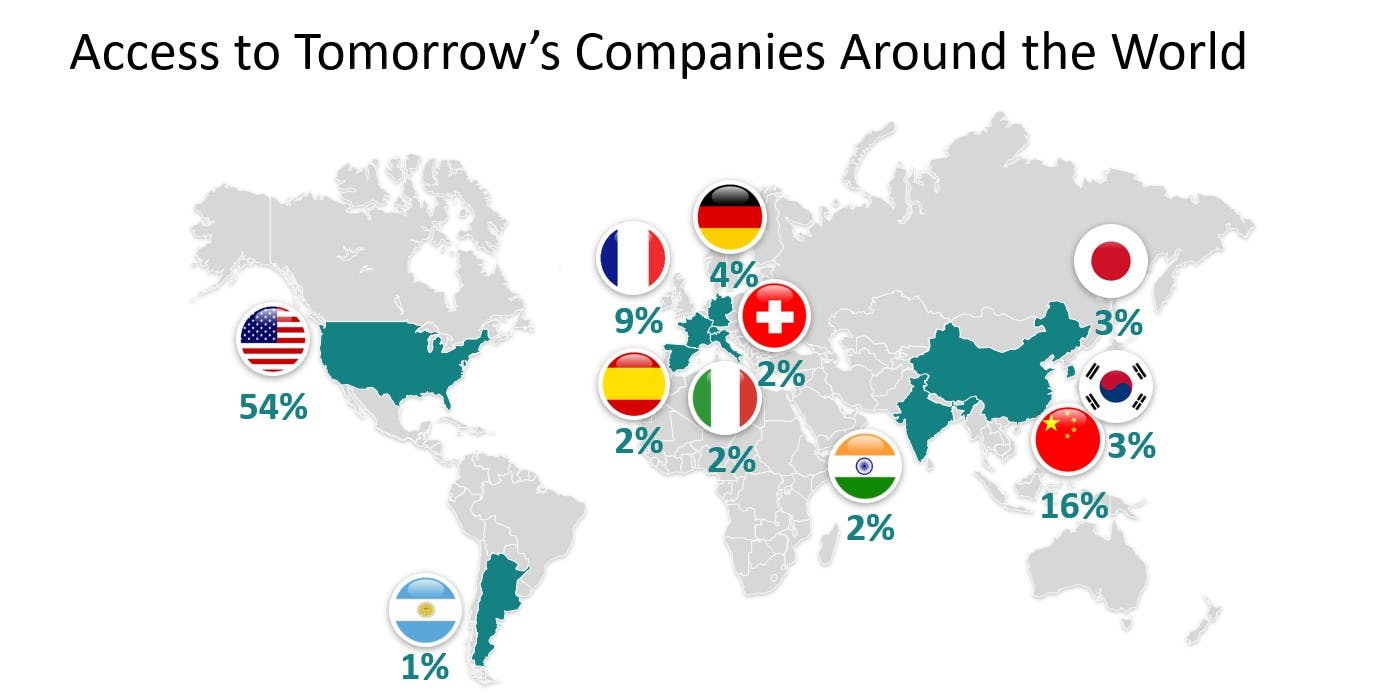

The geographic location where exposure remains elevated for the fund is China, where exposure rose again to 16%. Our investments in China remain focused on the same themes we have been expressing globally across the portfolio, namely Technology, Consumer Internet, and Healthcare. Two Chinese Electric Vehicle manufacturers, NIO and XiaoPeng, were added to the portfolio this quarter. We note that our Chinese exposure is focused on the domestic market, not companies dependent on U.S. technology or export markets.

Carmignac Investissement A EUR Acc

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

2024 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Investissement A EUR Acc | +10.39 % | +1.29 % | +2.13 % | +4.76 % | -14.17 % | +24.75 % | +33.65 % | +3.97 % | -18.33 % | +18.92 % | +17.03 % |

| Referentie-indicator | +18.61 % | +8.76 % | +11.09 % | +8.89 % | -4.85 % | +28.93 % | +6.65 % | +27.54 % | -13.01 % | +18.06 % | +10.61 % |

Scroll rechts om de volledige tabel te zien

| 3 jaar | 5 jaar | 10 jaar | |

|---|---|---|---|

| Carmignac Investissement A EUR Acc | +4.42 % | +11.38 % | +7.68 % |

| Referentie-indicator | +10.01 % | +11.76 % | +11.34 % |

Scroll rechts om de volledige tabel te zien

Bron: Carmignac op 28/03/2024

| Instapkosten : | 4,00% van het bedrag dat u betaalt wanneer u in deze belegging instapt. Dit is het hoogste bedrag dat u in rekening zal worden gebracht. Carmignac Gestion rekent geen instapkosten. De persoon die u het product verkoopt, informeert u over de daadwerkelijke kosten. |

| Uitstapkosten : | Wij brengen voor dit product geen uitstapkosten in rekening. |

| Beheerskosten en andere administratie - of exploitatiekos ten : | 1,50% van de waarde van uw belegging per jaar. Dit is een schatting op basis van de feitelijke kosten over het afgelopen jaar. |

| Prestatievergoedingen : | 20,00% max. van de meerprestatie als het rendement sinds het begin van het boekjaar hoger is dan dat van de referentie-indicator en er geen minderprestatie uit het verleden meer moet worden goedgemaakt. Het feitelijke bedrag zal variëren naargelang van de prestaties van uw belegging. De schatting van de totale kosten hierboven omvat het gemiddelde over de afgelopen vijf jaar, of sinds de introductie van het product als dat minder dan vijf jaar geleden is. |

| Transactiekosten : | 1,09% van de waarde van uw belegging per jaar. Dit is een schatting van de kosten die ontstaan wanneer we de onderliggende beleggingen voor het product kopen en verkopen. Het feitelijke bedrag zal varieert naargelang hoeveel we kopen en verkopen. |

Reference indicator: MSCI ACWI (USD) (Reinvested net dividends). Annualized performance as of 30/09/2020. Performance of the A EUR acc share class. Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged. Performances are net of fees (excluding possible entrance fees charged by the distributor). The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager. © 2020 Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Carmignac Investissement E EUR Acc

Het Risico-indicator kan variëren van 1 tot 7, waarbij categorie 1 overeenkomt met een lager risico en een lager potentieel rendement, en categorie 7 met een hoger risico en een hoger potentieel rendement. De categorieën 4, 5, 6 en 7 impliceren een hoge tot zeer hoge volatiliteit, met grote tot zeer grote prijsschommelingen die op korte termijn tot latente verliezen kunnen leiden.

Aanbevolen minimale beleggingstermijn

Laagste risico Hoogste risico

Risico's die in de indicator niet voldoende in aanmerking worden genomen:

TEGENPARTIJRISICO: Risico van verlies indien een tegenpartij niet aan haar contractuele verplichtingen kan voldoen.

LIQUIDITEITSRISICO: Risico dat tijdelijke marktverstoringen de prijzen beïnvloeden waartegen een ICBE zijn posities kan vereffenen, innemen of wijzigen.

Inherente risico's:

AANDELENRISICO: Risico dat aandelenkoersschommelingen, waarvan de omvang afhangt van externe economische factoren, het kapitalisatieniveau van de markt en het volume van de verhandelde aandelen, het rendement beïnvloeden.

VALUTARISICO: Het wisselkoersrisico hangt samen met de blootstelling, via directe beleggingen of valutatermijncontracten, aan andere valuta’s dan de waarderingsvaluta van de ICBE.

RISICO VERBONDEN AAN DISCRETIONAIR BEHEER: Het anticiperen op de ontwikkelingen op de financiële markten door de beheerder is van directe invloed op het rendement van de ICBE.

RISICO VAN KAPITAALVERLIES: Dit deelbewijs/deze aandelenklasse biedt geen garantie voor of bescherming van het belegde kapitaal. U ontvangt mogelijk niet het volledige belegde bedrag terug.

Meer informatie over de risico's van het deelbewijs/de aandelenklasse is te vinden in het prospectus, met name in hoofdstuk "Risicoprofiel", en in het document met essentiële beleggersinformatie.